We are excited to officially announce we have secured $30.5M in Series B funding!

Read more

Allocate institute

Explore a curated library of expert-driven articles, reports, and webinars designed to deepen your understanding of the private markets ecosystem

Join Samir Kaji for a data-driven look at private markets as 2025 concludes, and what the current landscape signals for the year ahead.

We'll unpack key trends including capital concentration in AI, valuation shifts, and early signs of IPO market activity - offering perspective for allocators and managers navigating today’s evolving environment.

A live Q&A session will follow the discussion.

Venture is evolving, and so are the managers shaping its future. This panel brings together Ben Taft (Genius Ventures), Katelin Holloway (Seven Seven Six), and Mark Goldberg (Chemistry), moderated by Allocate’s Camila Orozco Gil, for a sharp discussion on what it takes to build an enduring firm. They unpack how to source outside consensus, pick with conviction, and serve founders with empathy. Plus, they share how they’re building LP relationships grounded in transparency and long-term alignment. Whether you're tracking emerging GPs or building a thesis around early-stage capital, this session delivers fresh insight into what the next decade of venture might look like.

Allocate’s Nic Millikan moderated a discussion with Pejman Nozad (Pear VC), Bruce Leak (Playground Global), and Nicolas Szekasy (KASZEK). Each leader shared insights from their own experience - Pejman on Pear’s university-focused sourcing and hands-on support, Bruce on Playground’s deep technical conviction and founder-first approach, and Nicolas on KASZEK’s operator-led model and long-term commitment in Latin America. All agreed that building enduring firms requires a differentiated strategy, authentic relationships, and consistently delivering value to founders and LPs.

The lively discussion takes a data-driven view of the key trends and observations from the private markets, especially the venture capital industry. Insights are gleaned from our interactions with GPs across the ecosystem as we seek to uncover what to expect for the New Year.

Understanding how to construct a well-balanced and resilient portfolio is fundamental to long-term venture success. In this edition of the Allocate Institute Masterclass Series, we’ll take a deep dive into the science and strategy behind effective fund portfolio construction, featuring industry-leading GPs who have successfully navigated market cycles.

This session will guide you through private equity and its sub-asset classes, clarifying the distinctions between venture capital, growth equity, and buyouts. We'll highlight the critical importance of manager selection, and dive into the dynamics between limited and general partners. With a focus on why specialization is increasingly vital, we'll examine how to select managers that align with your unique investment strategy. Whether you're an experienced investor or new to the field, this webinar will equip you with the knowledge to navigate the Private Equity landscape more effectively.

The lively discussion takes a data-driven view of the key trends and observations from the venture capital industry. Insights are gleaned from our interactions with GPs across the venture ecosystems as we seek to uncover what to expect for the remainder of the year.

This session will guide you through private equity and its sub-asset classes, clarifying the distinctions between venture capital, growth equity, and buyouts. We'll highlight the critical importance of manager selection, and dive into the dynamics between limited and general partners. With a focus on why specialization is increasingly vital, we'll examine how to select managers that align with your unique investment strategy. Whether you're an experienced investor or new to the field, this webinar will equip you with the knowledge to navigate the Private Equity landscape more effectively.

Venture Capital is an exciting and distinctive asset class because, unlike any other modern asset class, it is powered by innovation. However, investing in innovation can prove to be challenging for investors. Many think of venture capital as a subset of private equity and often use a PE-style playbook to assess venture capital investments. While some techniques are similar, venture capital presents its own set of challenges, and may have fewer quantitative data points to analyze.

In this webinar, Allocate's MD of Investments, Nic Millikan and MD of Relationship Management, Peter Epstein, will share their insights and considerations on LP venture capital portfolio construction. They will cover everything from the basics to the nuances of building thoughtful, customized, and effective venture capital exposure in a portfolio context.

This comprehensive guide takes you through predictions for the venture capital market in 2024 and captures insights from venture fund managers and limited partners.

This educational session, hosted by Nic Millikan, Managing Director of Investments at Allocate, and Taylor Adams, Founder and CEO of Belief Partners is designed to equip investors with the knowledge and a clear foundation to develop an institutional-grade venture capital allocation that is strategic, programmatic, and personalized.

This session provides an overview of the venture capital fund portfolio management where participants will gain insights into tracking and monitoring venture capital fund positions.

Our second module in our venture capital education series to discuss firm types, structures, and strategies.

An overview of venture capital, how to approach investing in the innovation economy, and what the future holds for this asset class.

An educational roundtable discussion on how to originate an institutional-grade venture capital allocation strategy, featuring Hana Yang (Co-founder, Allocate) and Taylor Adams (Family Office).

We are excited to host our semi-annual state of venture discussion where we take a data-driven view of venture capital trends and observations. This is a must for anyone seeking to get the latest trends in investment activity, on what we are seeing with fund managers, and a look ahead to what we expect to see in the coming year.

Insights from the next generation of venture capital leadership.

Featuring Samir Kaji (CEO & Co-founder, Allocate) and Matt Curtolo (Former Head of Investments, Allocate)

Featuring Samir Kaji (Co-founder, CEO of Allocate), Rebecca Kaden (General Partner at Union Square Ventures), Frank Rotman (Co-founding Partner at QED Investors), Ashmeet Sidana (Chief Engineer and Co-founding Partner at Engineering Capital)

This article explains Fund of Funds and how venture capital investing requires meticulous manager selection, given the wide dispersion of returns between funds.

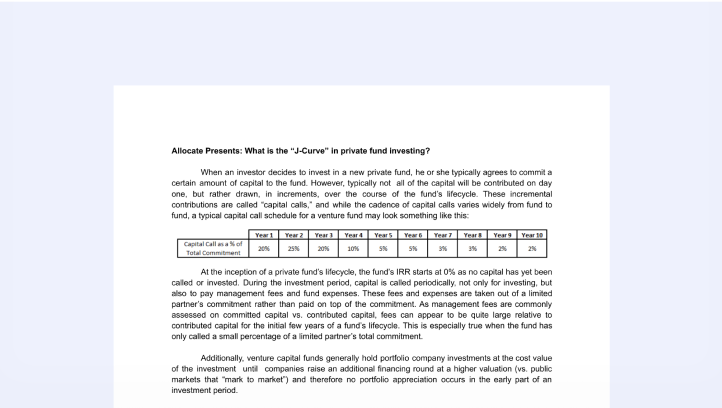

This article covers terminology needed to be successful as a venture capital investor. You'll learn about capital calls, fund lifecycle, and how the J-Curve relates to today's market dynamics.

The article explains how "recycling" in private fund investing allows funds to reinvest proceeds from early liquidity events or recall distributions to invest more than the initial capital commitment.

This article emphasizes the importance of systematic processes and network-based strategies to avoid adverse selection and increase the likelihood of capturing high-return opportunities, especially in a normalized market where performance disparities are more pronounced.

The article examines the contrasting business models of small and large venture capital funds, noting that small funds often have the potential for higher top-end returns due to the significant impact of a single successful investment.

This article presents findings using cash-flow data sourced from Burgiss’s large sample of institutional investors. It encourages a fresh perspective on investment strategies, highlighting the enduring value of venture capital investments and offering new insights into buyout fund performance.

-min.png)

Venture is evolving, and so are the managers shaping its future. This panel brings together Ben Taft (Genius Ventures), Katelin Holloway (Seven Seven Six), and Mark Goldberg (Chemistry), moderated by Allocate’s Camila Orozco Gil, for a sharp discussion on what it takes to build an enduring firm. They unpack how to source outside consensus, pick with conviction, and serve founders with empathy. Plus, they share how they’re building LP relationships grounded in transparency and long-term alignment. Whether you're tracking emerging GPs or building a thesis around early-stage capital, this session delivers fresh insight into what the next decade of venture might look like.

This session will guide you through private equity and its sub-asset classes, clarifying the distinctions between venture capital, growth equity, and buyouts. We'll highlight the critical importance of manager selection, and dive into the dynamics between limited and general partners. With a focus on why specialization is increasingly vital, we'll examine how to select managers that align with your unique investment strategy. Whether you're an experienced investor or new to the field, this webinar will equip you with the knowledge to navigate the Private Equity landscape more effectively.

-min.png)

Allocate’s Nic Millikan moderated a discussion with Pejman Nozad (Pear VC), Bruce Leak (Playground Global), and Nicolas Szekasy (KASZEK). Each leader shared insights from their own experience - Pejman on Pear’s university-focused sourcing and hands-on support, Bruce on Playground’s deep technical conviction and founder-first approach, and Nicolas on KASZEK’s operator-led model and long-term commitment in Latin America. All agreed that building enduring firms requires a differentiated strategy, authentic relationships, and consistently delivering value to founders and LPs.

The lively discussion takes a data-driven view of the key trends and observations from the private markets, especially the venture capital industry. Insights are gleaned from our interactions with GPs across the ecosystem as we seek to uncover what to expect for the New Year.

Understanding how to construct a well-balanced and resilient portfolio is fundamental to long-term venture success. In this edition of the Allocate Institute Masterclass Series, we’ll take a deep dive into the science and strategy behind effective fund portfolio construction, featuring industry-leading GPs who have successfully navigated market cycles.

The lively discussion takes a data-driven view of the key trends and observations from the venture capital industry. Insights are gleaned from our interactions with GPs across the venture ecosystems as we seek to uncover what to expect for the remainder of the year.

This session will guide you through private equity and its sub-asset classes, clarifying the distinctions between venture capital, growth equity, and buyouts. We'll highlight the critical importance of manager selection, and dive into the dynamics between limited and general partners. With a focus on why specialization is increasingly vital, we'll examine how to select managers that align with your unique investment strategy. Whether you're an experienced investor or new to the field, this webinar will equip you with the knowledge to navigate the Private Equity landscape more effectively.

Venture Capital is an exciting and distinctive asset class because, unlike any other modern asset class, it is powered by innovation. However, investing in innovation can prove to be challenging for investors. Many think of venture capital as a subset of private equity and often use a PE-style playbook to assess venture capital investments. While some techniques are similar, venture capital presents its own set of challenges, and may have fewer quantitative data points to analyze.

In this webinar, Allocate's MD of Investments, Nic Millikan and MD of Relationship Management, Peter Epstein, will share their insights and considerations on LP venture capital portfolio construction. They will cover everything from the basics to the nuances of building thoughtful, customized, and effective venture capital exposure in a portfolio context.

This educational session, hosted by Nic Millikan, Managing Director of Investments at Allocate, and Taylor Adams, Founder and CEO of Belief Partners is designed to equip investors with the knowledge and a clear foundation to develop an institutional-grade venture capital allocation that is strategic, programmatic, and personalized.

This session provides an overview of the venture capital fund portfolio management where participants will gain insights into tracking and monitoring venture capital fund positions.

Our second module in our venture capital education series to discuss firm types, structures, and strategies.

An overview of venture capital, how to approach investing in the innovation economy, and what the future holds for this asset class.

An educational roundtable discussion on how to originate an institutional-grade venture capital allocation strategy, featuring Hana Yang (Co-founder, Allocate) and Taylor Adams (Family Office).

We are excited to host our semi-annual state of venture discussion where we take a data-driven view of venture capital trends and observations. This is a must for anyone seeking to get the latest trends in investment activity, on what we are seeing with fund managers, and a look ahead to what we expect to see in the coming year.

Insights from the next generation of venture capital leadership.

Featuring Samir Kaji (CEO & Co-founder, Allocate) and Matt Curtolo (Former Head of Investments, Allocate)

Featuring Samir Kaji (Co-founder, CEO of Allocate), Rebecca Kaden (General Partner at Union Square Ventures), Frank Rotman (Co-founding Partner at QED Investors), Ashmeet Sidana (Chief Engineer and Co-founding Partner at Engineering Capital)

This comprehensive guide takes you through predictions for the venture capital market in 2024 and captures insights from venture fund managers and limited partners.

This article explains Fund of Funds and how venture capital investing requires meticulous manager selection, given the wide dispersion of returns between funds.

This article covers terminology needed to be successful as a venture capital investor. You'll learn about capital calls, fund lifecycle, and how the J-Curve relates to today's market dynamics.

The article explains how "recycling" in private fund investing allows funds to reinvest proceeds from early liquidity events or recall distributions to invest more than the initial capital commitment.

This article emphasizes the importance of systematic processes and network-based strategies to avoid adverse selection and increase the likelihood of capturing high-return opportunities, especially in a normalized market where performance disparities are more pronounced.

The article examines the contrasting business models of small and large venture capital funds, noting that small funds often have the potential for higher top-end returns due to the significant impact of a single successful investment.

This article presents findings using cash-flow data sourced from Burgiss’s large sample of institutional investors. It encourages a fresh perspective on investment strategies, highlighting the enduring value of venture capital investments and offering new insights into buyout fund performance.